Helping SMEs manage working capital. Supporting lenders and borrowers to navigate through working capital challenges

Challenges businesses face

Increasingly SME’s are struggling to manage working capital – particularly the relationship between profit and cash. In our experience business owners are often not equipped to deal with the challenges of managing working capital, and lenders do not have the skillset or capacity to support SME’s in the way that they need to fully maximise their working capital cycle.

Common situations

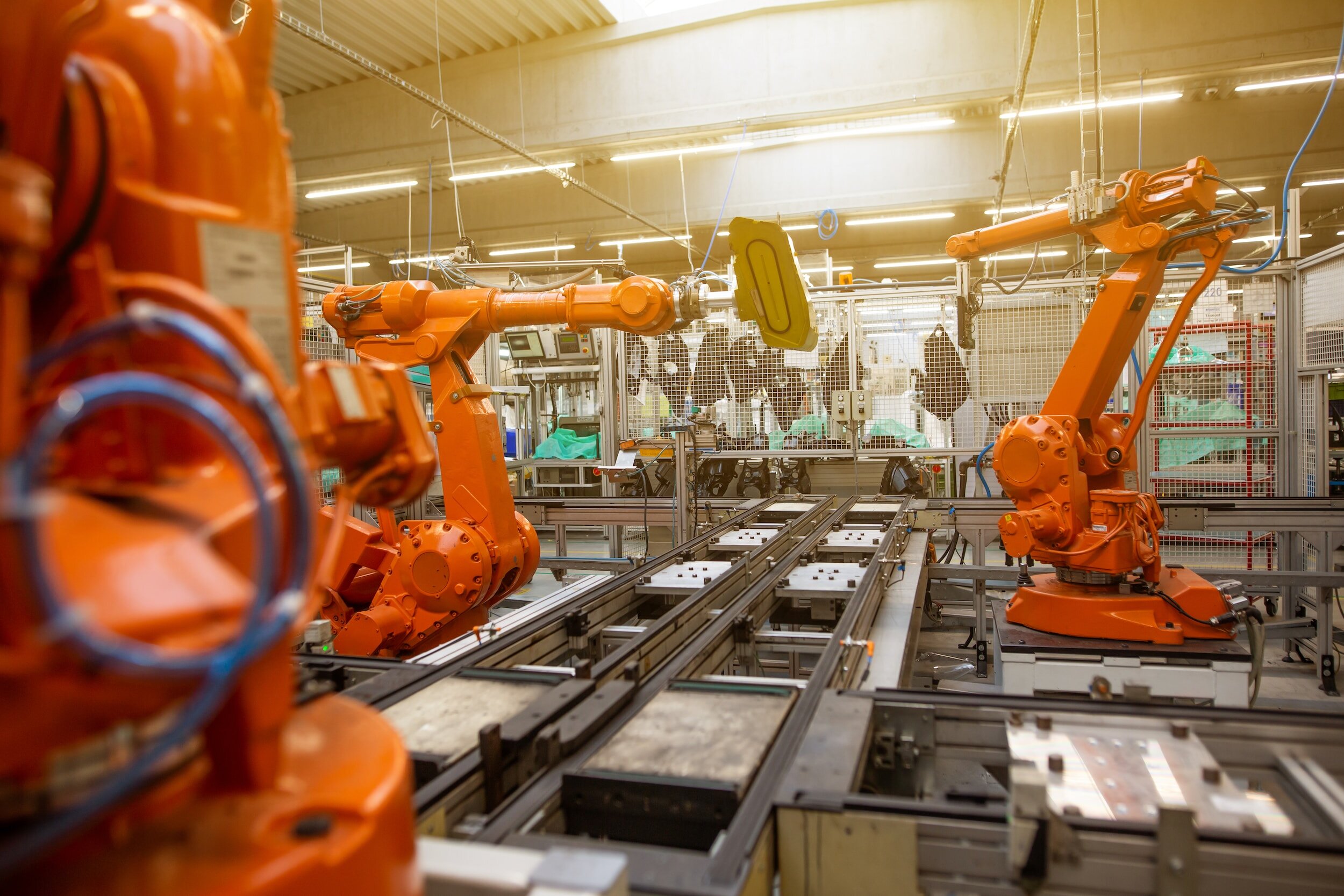

Regularly, we encounter situations where accounting profits have been extracted by the shareholders, on the basis that this is cash available within the business. For a manufacturing business this may not be the case, and even a small shift in stock turn, debtor and creditor payment times can have a significant effect, increasing the cash requirements of the business. Or it maybe that an existing lender does not have the capacity, capability or desire to continue funding a business, and alternative funding is required.

What we offer

At Ricosta Capital, we have a deep understanding of the challenges that SME’s face in managing their working capital cycle. We review your business to understand the working capital cycle and also gain in depth knowledge of the cash management needed to operate a business. With knowledge and expertise gain over many years, we have been able to deliver solutions to numerous businesses, transforming to improve their working capital and operating position.

Read relevant case studies: